Avoiding the SaaS valley of death: 3 Pitfalls to avoid when scaling to $10M in ARR and beyond

The phrase “valley of death” might sound ominous and a bit melodramatic, but the stark reality is that only 4% of SaaS companies reach $1M in Annual Recurring Revenue (ARR), and only 10% of those - 0.4% overall, reach $10M.

If you’re reading this, there’s a good chance you’re getting to real scale in your business. And that means you’ve already accomplished quite a bit (establishing product-market fit, attaining a cohort of paying customers who are renewing, and keeping churn to a minimum). That’s no easy feat, so congratulations!

As you move into the next phase, you’ll face a new set of challenges, both as you scale to $10M in ARR, and then beyond. At Riverside Acceleration Capital, and in prior roles, we’ve helped many successful companies navigate these waters and then scale their businesses beyond the $10M ARR mark.

They owe their success, in part, to avoiding common pitfalls that growing businesses face, including: selling to the wrong customers; failing to evolve their sales model; and hiring too fast or too slow. I’ll explore each of these pitfalls and how to avoid them, along with a few additional considerations.

Pitfall #1: Selling to the wrong customers

In the beginning stages of a SaaS startup, it can be tempting to sell to as many customers as possible. After all, revenue is revenue, right?

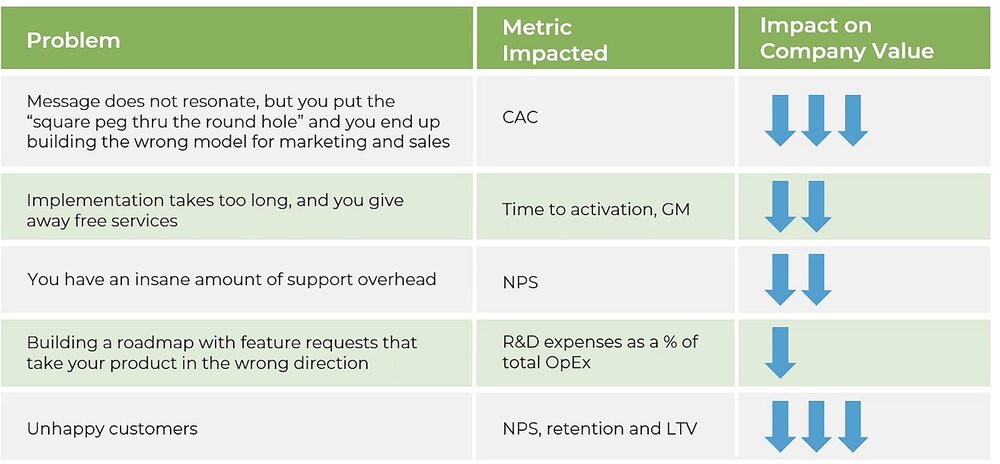

There are several major issues with this approach that could lead to the collapse of your business before you reach the $10M ARR milestone. Targeting the wrong customers can impact your Customer Acquisition Costs (CAC), implementation and time-to-activation, Net Promoter Score (NPS), Retention rate, R&D expenses, Customer Lifetime Value (LTV), and ultimately your Gross Margins (GM).

The following chart explains why:

Aligning your value proposition to your ideal customers is vital to the survival of your business, and not only due to its inevitable impact on ARR. In the end, no sophisticated investor who studies the numbers would invest in a company with a poor showing in these metrics.

(Re)defining your ideal customer

Your current ideal customer may not be the same ideal customer you identified when you started your business. Don’t be afraid to rethink your definitions as your company evolves. Evaluate (and continually reevaluate) who is using your product and who derives the most value from it.

When defining your ideal customer, look at the following attributes:

- Industry/vertical

- Employee headcount

- Annual revenue

- Budget

- Geography

- Technology they use

- Size of their customer base

- Level of organizational or technological maturity

Finally, when crafting your messaging and designing your systems for the buyer personas you create, start by asking yourself: “What are these customers’ needs and drives? What problems are we solving for them?”

Too often, businesses focus their messaging entirely on what they do. Instead, identify customer pain points and how you can make their lives easier, and re-evaluate as you continue to grow and develop. That’s how you’ll win them over.

Pitfall #2: Failure to evolve your sales model

There’s a good chance you remember a time when your entire sales staff consisted of the CEO and maybe one other. Needless to say, that stops working at a certain point and you have to start hiring a real sales staff. With every new batch of hires, your sales model needs to evolve to incorporate greater specialization—otherwise it will be inefficient and riddled with missed opportunities.

How should your sales model evolve?

Your sales model, at any given stage, should be guided primarily by two factors: Average Selling Price (ASP) and the complexity of your product.

Average Selling Price: More than any other factor, ASP has the biggest influence over your sales model, and it has an inverse relationship with sales volume. In other words, the higher your ASP, the fewer deals you have to close to bring in revenue, which is the lifeblood of your business.

The higher your ASP, the more you’ll see:

- Narrowly defined target markets

- Longer sales cycles

- Outbound customer acquisition efforts (wining and dining prospects)

- In-depth customer service

- Extensive onboarding

- Customization

The lower your ASP, the more you’ll see:

- Broad target markets

- Short sales cycles

- Inbound marketing to attract leads

- Automation (because labor is expensive, slow, and doesn’t scale well)

Complexity

The more complex it is to purchase your product and onboard customers, the more help customers will need. In other words, high complexity translates to higher costs.

The struggle here is that just because your product is more complex, it doesn’t mean customers will be willing to pay more for it. In other words, if your product is complex but you can’t justify a high ASP, you’ll need to strike a balance between providing the proper guidance and keeping your acquisition costs low enough that each sale remains profitable.

Designing the right sales model for your company

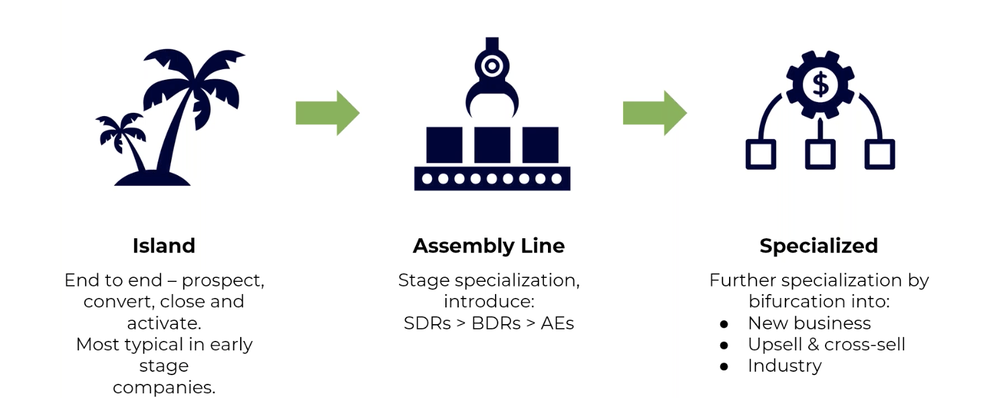

Again, the right sales model will change over time. In general, you’ll move along a path from the Island Model (where each Account Executive works independently), to the Assembly Line Model (where you’ve got different teams finding leads, closing deals, and nurturing accounts), to a highly specialized model (which includes teams focused on new business, cross-sell/upsell, etc.).

The lines between these various stages aren’t strict, and you’ll need to adapt them to your customers’ needs—guided by your ASP, product complexity, and overall budget.

Pitfall #3: Hiring sales reps too quickly or too slowly

Hiring while your business scales is like hitting a moving target with an arrow—you have to release the bow at just the right moment, based on where you believe the target will be at a distant point in time and space.

Since it takes around two to three quarters for a newly hired sales rep to ramp up to full capacity, you’ve got to hire early enough for them to handle incoming business 6-9 months down the line. If you hire too early, they’ll end up twiddling their thumbs (and costing you money, which costs you runway), but if you hire too late your sales team will be forced to scramble and miss valuable opportunities (which will cost you growth).

Sales efficiency

The most widely accepted indicator for hiring sales staff is sales efficiency, which is derived by dividing your ARR (less the cost of providing the service) by the amount you’ve invested in sales and marketing. A sales efficiency of 1 or more indicates that it’s time to start investing more of your operating expenses into the sales and marketing budget.

Example: A company invests $500,000 in Sales and Marketing and achieves an ARR of $1,000,000. Therefore, its sales efficiency is 2.

A formula for hiring

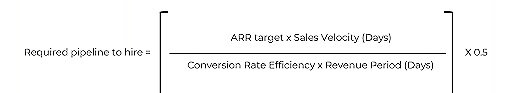

The following formula will help you determine when to hire more sales staff.

A few notes about this formula:

- ARR target: This represents the ARR quota for a fully ramped salesperson.

- Sales velocity: This is the number of days it takes to close a deal (i.e., sales cycle length).

- Conversion rate: This is the aggregate prevailing effectiveness of your current sales team to convert the gross sales pipeline. Example: If you have a gross pipeline of $100k in ARR and you close $20k of it within the revenue period, then your conversion rate is 20%.

- Revenue period: This is defined by the number of days in whatever period you choose to evaluate performance (e.g., 90 days in a quarter, 365 days in a year).

By looking ahead and taking a data-driven approach to ramping up your sales team, you’ll set yourself up for successful scaling and ultimate success.

Additional advice for scaling a SaaS business

Beyond navigating past these common pitfalls, here are a few additional tips for SaaS executives to follow as you scale your business.

Never stop innovating: Once you’ve got an established business with a product that your customers love, it can be tempting to rest on your laurels—but you can never afford to stop wowing your customers. Gather regular feedback and put a healthy portion of your profits into R&D so you can create an ever-evolving product that matches their needs.

Obsess over customer success and retention: Gather feedback to measure your Customer Satisfaction (CSAT), Customer Effort Score (CES), and Net Promoter Score (NPS). And of course, keep an eye on your churn rate. Use this data to fix issues and ensure that your customers love your product and keep coming back.

Ongoing optimization: Identify and evaluate the Key Performance Indicators (KPIs) relevant to your business. Measure every important element of your business. Measure and monitor your KPIs continually. Remember, if you can’t measure it, you can’t fix it.

Implement effective processes everywhere (especially in finance): As a startup, you can get by without too many established processes. As you scale, your organization needs detailed processes to become more efficient and provide consistent service to both your internal and external customers.

Seeing the big picture

Needless to say, there are a lot of moving parts when it comes to scaling a SaaS business. You’ll inevitably do some things right, while you’ll miss the mark in other areas. What’s important is to follow guiding principles (like these), and to continue to learn from your mistakes, and adapt to the changing needs of the market.

Companies scaling to $10M in ARR face a much different set of challenges than those trying to make their first million (and, for that matter, those scaling to $100M). At Riverside Acceleration Capital, we invest in (and advise) B2B software companies who have reached an acceleration point—so we work with a lot of businesses who are in and around this particularly tricky phase.

Learn more about our approach to empowering B2B SaaS companies and helping them scale to (and well beyond) $10M in ARR at www.riverside.ac.

We love meeting new software companies, so let's talk.